23+ Wedding Gift Tax Allowance Uk, Wedding Inspiraton!

March 10, 2022

Money gift from abroad tax uk , Inheritance tax UK , UK Inheritance tax on property , Capital gains tax uk inheritance , Uk Inheritance tax shares , Is paying for a wedding a taxable gift , Trust UK , Gift wedding tax , Gov uk deaths , IHT205 , Income tax on gifts UK , Deceased estate uk ,

23+ Wedding Gift Tax Allowance Uk, Wedding Inspiraton! - Opulent wedding design takes an extra dose of love and care, and the massive team and designers sourced for this luxurious styled shoot went above and beyond to hit the mark. From a floral adorned, six tier wedding cake to six stunning couture wedding gift.

If you want your wedding gift to be different from the others, then you should just buy it. However, if your budget is not enough, it is better to choose to rent it.Here is what we say about wedding gift with the title 23+ Wedding Gift Tax Allowance Uk, Wedding Inspiraton!.

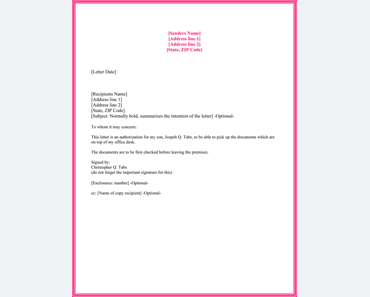

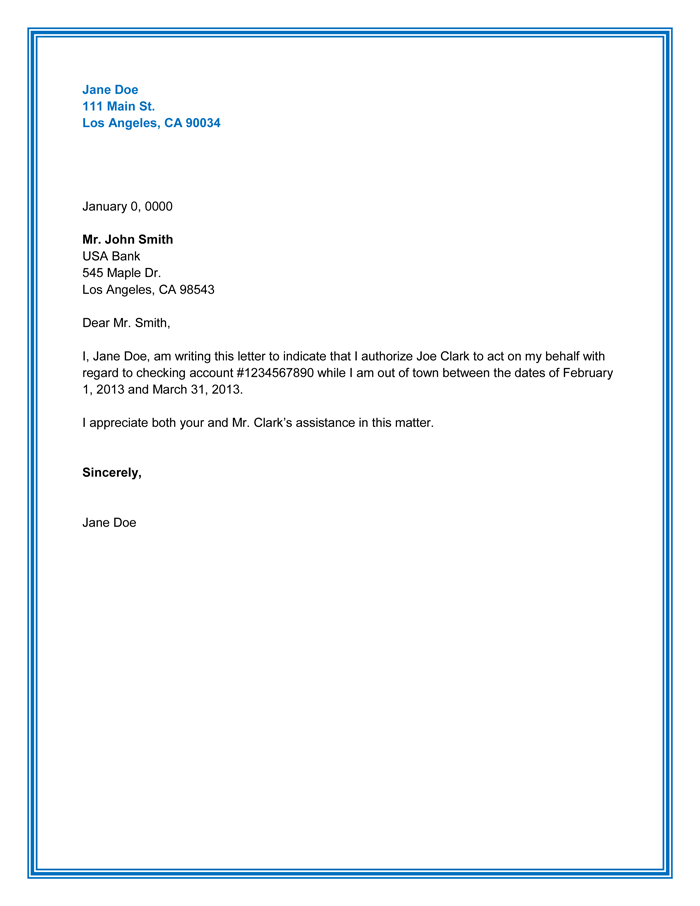

25 Best Authorization Letter Samples Formats Templates Source : www.wordtemplatesonline.net

Gifts and exemptions from Inheritance Tax

All taxpayers are eligible to take advantage of an annual IHT gift allowance of £3 000 per financial year and records should be kept of all gifts given including wedding gifts In addition for those making smaller cash gifts there is the Small Gifts Exemption that can be taken advantage of which allows as many gifts of under £250 to be made as you wish they will all be exempt

BerlinWeed Net Kaufen Sie das beste Marihuana in Source : berlinweed.net

Gifting money in the UK explained Raisin UK

If youre their grandparent you can give up to £2 500 tax free For anyone else you can give up to £1 000 tax free However if the wedding or civil partnership is called off and youve already given a gift itll no longer be exempt from Inheritance Tax

Stag Silhouette Large Rubber Stamp Source : www.stampaddicts.com

Wedding gifts and the tax implications Private

11 06 2022 · Wedding gifts are not subject to tax within certain limits parents are able to gift up to £5 000 per child and grandparents up to £2 500 per grandchild while other relatives and

Floating Bedside Table With Drawer And Shelf By Urbansize Source : www.notonthehighstreet.com

How do I gift money without being taxed

An individual can provide gifts of £3 000 each tax year 6 April to 5 April without these being adding to value of their estate on death This is known as the annual exemption Whilst this is the case it is a misconception that the limit is £3 000

Zohula Originals Flip Flops White 10 Pairs Wedding Source : www.weddingflipflops.co.uk

Marriage Allowance GOV UK

Zohula Originals Flip Flops White 10 Pairs Wedding Source : www.weddingflipflops.co.uk

Inheritance Tax on Wedding Gifts Folkes Worton

Gifts worth more than the £3000 allowance in any tax year might be subject to Inheritance Tax What else can I give tax free Gifts that are worth less than £250 You can give as many gifts of up to £250 to as many individuals as you want Although not to anyone who has already received a gift of your whole £3 000 annual exemption None of these gifts are subject to Inheritance Tax Wedding gifts

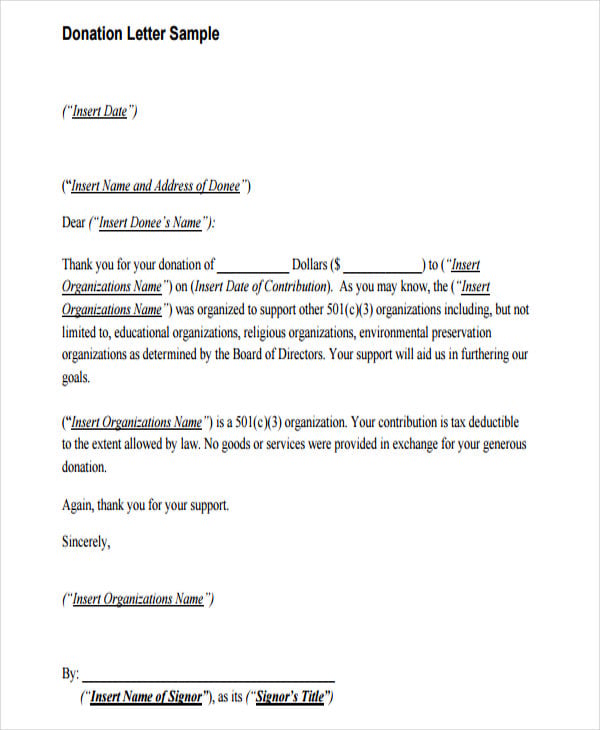

13 Gift Letter Templates Word PDF Free Premium Source : www.template.net

The myth of the £3 000 gift Johnston Carmichael

Answering the question HMRC will for each donor give only one exemption under IHTA s 22 which refers to parties to a marriage If donors are not domiciled or deemed domiciled in the UK IHTA does not apply at all to any gifts Thanks 0

Money gift from abroad tax uk , Inheritance tax UK , UK Inheritance tax on property , Capital gains tax uk inheritance , Uk Inheritance tax shares , Is paying for a wedding a taxable gift , Trust UK , Gift wedding tax , Gov uk deaths , IHT205 , Income tax on gifts UK , Deceased estate uk ,

Pottery 9th Anniversary Gifts for Him Amazing Source : uniquegifter.com

Wedding gifts hmrc AccountingWEB

19 02 2022 · you do not pay Income Tax or your income is below your Personal Allowance usually £12 500 your partner pays Income Tax at the basic rate which usually means their income is

Buy discount Starting from ¡ê24 Kate Fall Reeds Scenery Source : www.katebackdrop.co.uk

Inheritance Tax Gifts GOV UK

13 10 2022 · Inheritance Tax on Wedding Gifts Each Parent including Step Parents can gift up to £5 000 tax free Grandparents and Great Grandparents can each gift up to £2 500 Any other person can each gift up to £1 000

How to Write Authorization Letter With Writing Tips Source : authorizationletter.net

How much money can you give as a gift in the UK

Youre entitled to an annual tax free gift allowance of £3 000 This is also known as your annual exemption With your annual gift allowance you can give away assets or money up to a total of £3 000 without them being added to the value of your estate Once youve exceeded this allowance the gifts you give may be subject to inheritance tax in the event of your death

BLUE HEARTS TEAPOT Polish pottery Shop UK Stoneware from Source : www.artpolishpottery.co.uk

Karen McConnell at The Royal Highland Show Hiho Silver Source : www.hihosilver.co.uk